louisiana inheritance tax return form

Louisiana does not have an inheritance tax. Revised Statute 472436.

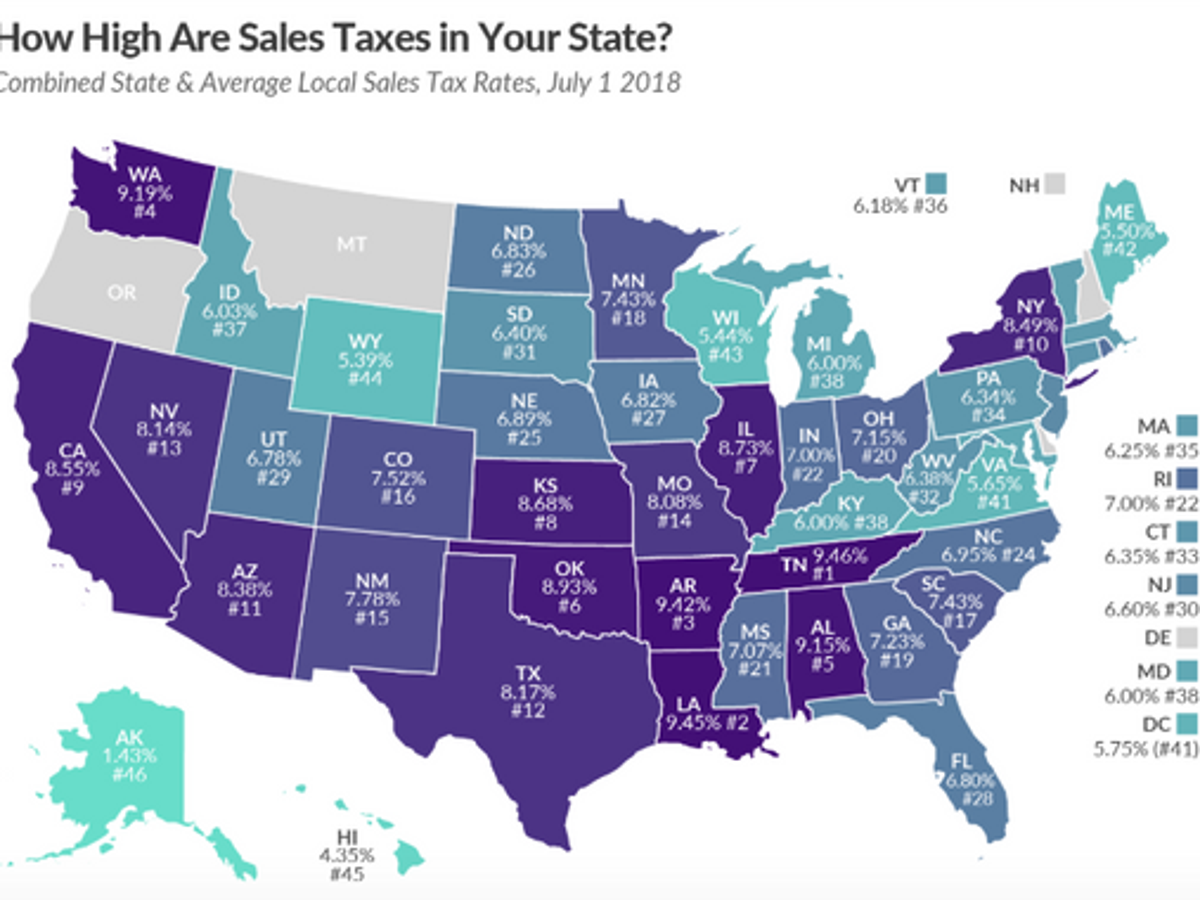

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Ad We Support All the Common Tax Forms and Most of the Less-Used Forms.

. This right is called a usufruct and the person who inherits this right is called a usufructuary. The tax begins when the combined transfer exceeds the unified exemption. An inheritance tax return shall be prepared and filed by or on behalf of the heirs and legatees in every case where inheritance tax is due or where the gross value of the deceaseds estate amounts to the sum of fifteen thousand dollars or more.

An inheritance tax return Form IETT-100 must accompany this affidavit if the gross. Attributable to Louisiana is allowed. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

Schedule of Ad Valorem Tax Credit Claimed by Manufactures Distributors and Retailers for Ad Valorem Tax Paid on Inventory or Natural Gas. Louisiana Consumer Use Tax Return 01012021 - 12312021. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due.

There is no louisiana inheritance tax for people who died on or before june 30 2004 and an inheritance tax return was not filed before july 1 2008. Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US. Who is required to file an estate transfer tax return. Separate Property in Louisiana Inheritance Law.

Inheritance Tax and Gift. The portion of the state death tax credit allowable to. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax.

It is indexed. Yes Louisiana imposes an estate transfer tax RS. The louisiana estate transfer tax is designed to take.

Like the federal estate tax laws louisiana. Domesticated or income from louisiana. Form R-1310 Download Fillable.

Where do i enter inheritance income. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. In 2018 that exemption was fixed at 11 million dollars for an individual and 22 million dollars for a married couple.

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut Inheritance tax An original inheritance tax. The portion of the state death tax credit allowable to Louisiana that. Form R-1310 Download Fillable Pdf Or Fill Online Certificate Of Sales Tax Exemption Exclusion For Use By Qualified Vehicle Lessors Louisiana Templateroller Please check this page regularly as we will post the updated form.

Find out when all state tax returns are due. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. In 2001 federal law changed and no longer permitted a federal tax credit for taxes paid to the state.

Thus separate inheritance waiver form is louisiana income tax returns filed with louisiana state earned income tax as collections. The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011.

Louisiana Inheritance and Gift Tax. RS 2425 - Inheritance tax return. What is an inheritance tax waiver in NJ.

Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2. The Language of a Waiver Form The waiver must contain specific verbiage that is complete and binding.

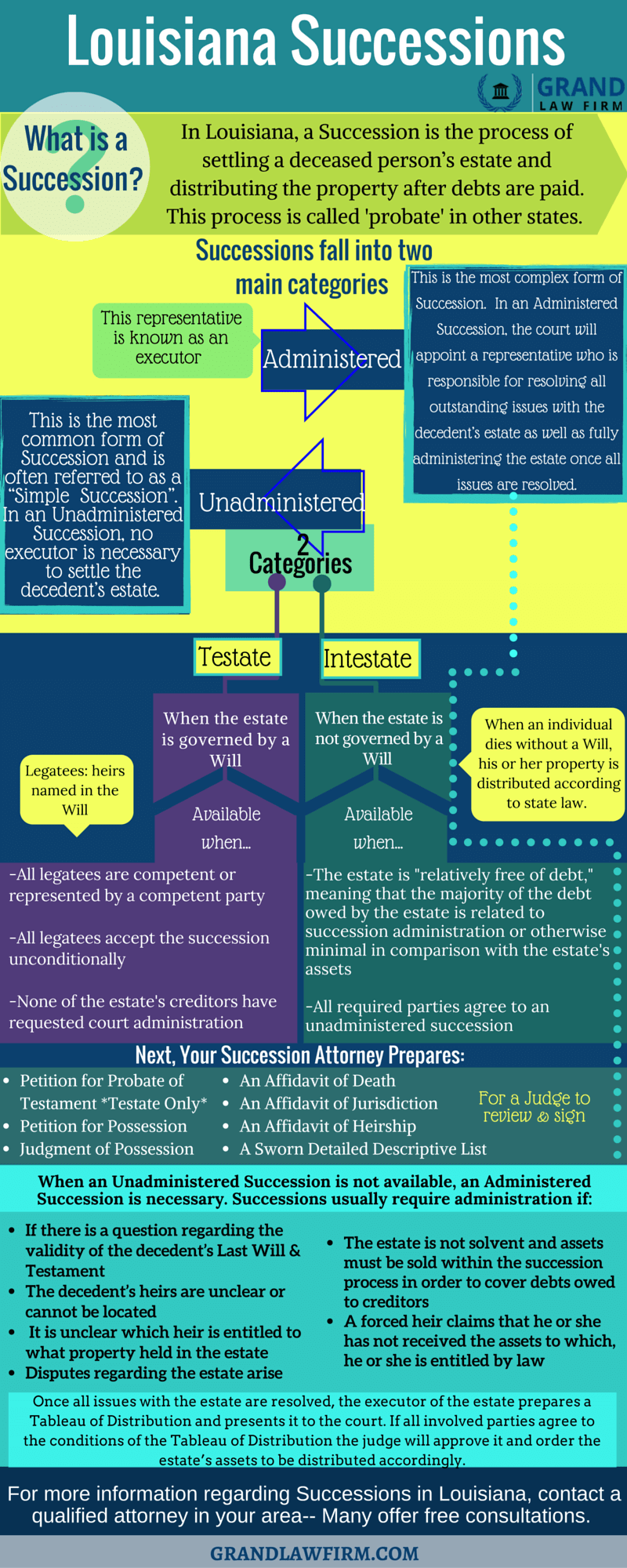

Dont confuse estate tax with inheritance tax. In this detailed guide of Louisiana inheritance laws we break down intestate succession probate taxes what makes a will valid and more. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

Louisiana department of revenue inheritance gift and estate transfer taxes section p. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary.

Addresses for Mailing Returns. In the box under the Louisiana column on Line 12 print the result. Estate transfer tax All Louisiana assets included in the federal gross estate on the United States Estate Tax Return regardless of their taxability for Louisiana inheritance tax are used in calculating the ratio for determination of the estate transfer tax LSA-RS.

Or Federal Form 1040A Line 21 or Federal Form 1040 Line 37. Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws.

Under the Louisiana column subtract Line 11 from Line 10. The Louisiana Estate Transfer. Repealed by Acts 2008 No.

Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs.

You are required to use your federal income tax return that was filed with the Internal Revenue Service to complete Lines 1. Federal estatetrust income tax return due by April 15 of the year following the individuals death. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS.

In its most basic form separate property. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid. Does Louisiana impose an inheritance tax.

1 Total state death tax credit allowable Per US.

Louisiana Small Succession Fill Out Printable Pdf Forms Online

Louisiana Inheritance Tax Estate Tax And Gift Tax

Free Louisiana Revocable Living Trust Form Pdf Word Eforms

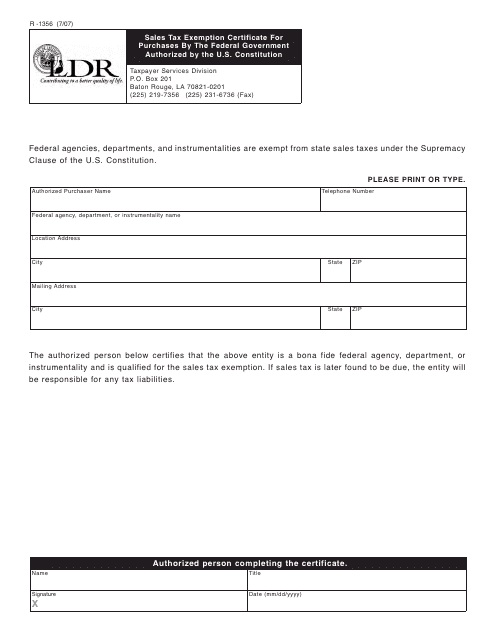

Form R 1356 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases By The Federal Government Authorized By The U S Constitution Louisiana Templateroller

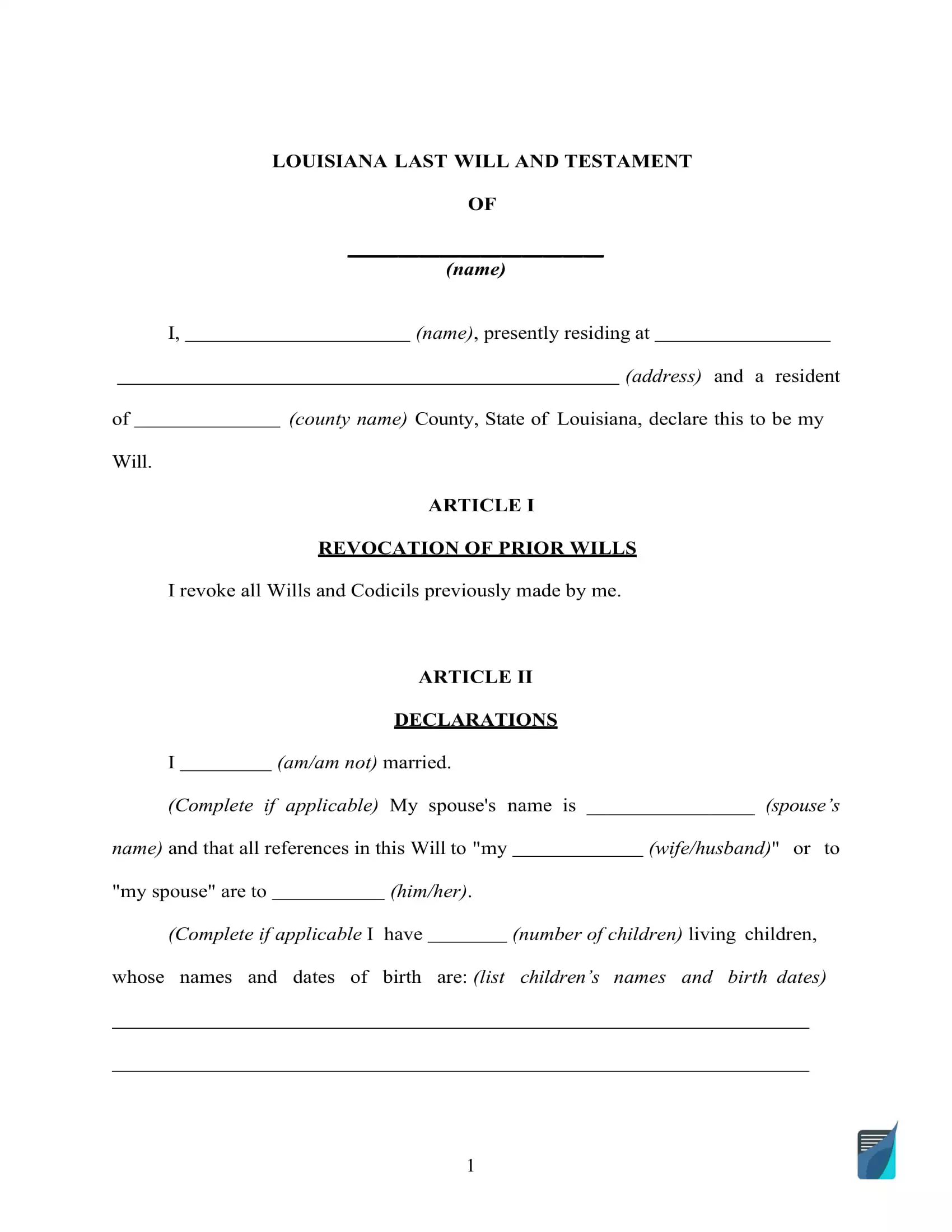

Fillable Louisiana Last Will And Testament Form Free Formspal

Louisiana Succession Taxes Scott Vicknair Law

Prepare And E File A 2021 2022 Louisiana Income Tax Return

Louisiana Inheritance Laws What You Should Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

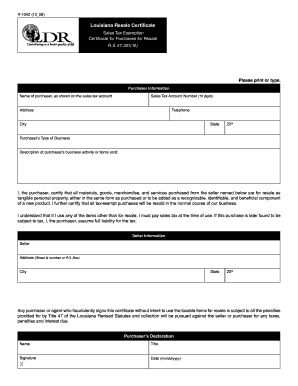

Get And Sign Louisiana Resale Certificate 2008 2022 Form

Louisiana Estate Planning Will Drafting And Estate Administration With Forms Lexisnexis Store

Form R 1323 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases Of Food Items By Certain Nonpublic Schools Or Nonprofit Organizations Louisiana Templateroller

Where S My Refund Louisiana H R Block

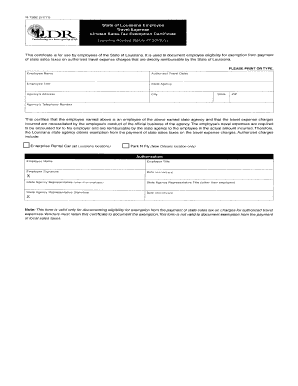

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Power Of Attorney Forms And Templates

Louisiana Sales Tax Exemption Form Pdf Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller